In April 2016, Adisseo announced rise in net

profit in its full-year 2015 financial figures, thanks to the exchange of

major assets and company restructuring. Meanwhile, its animal nutrition

business also recorded YoY rise, due to the lower production cost and rising

market price of methionine. In 2016, the company’s larger sales contributed to

its upward financial performance, despite the falling market price of

methionine. Thus, Adisseo plans to take its advantages in supply for larger

sales in the later period.

On 14 April, 2016, Bluestar Adisseo Company (Adisseo)

released its financial figures in full-year 2015.

-

Revenue: USD2.35 billion (RMB15.17 billion), down by 22% YoY

-

Net profit: USD236.69 million (RMB1.53 billion), up by 4% YoY

The rises were mainly

attributed to Adisseo’s exchange of major assets and company restructuring.

On July 27, 2015, the company:

1. Acquired 85% of the shares

in Bluestar Adisseo Nutrition Group Ltd. (Bluestar Adisseo)

2. Transferred all Bluestar

New Chemical Materials Co., Ltd. (Bluestar New Chemical, predecessor of

Adisseo)’s rights and obligations of assets to China National Bluestar (Group)

Co., Ltd. (Bluestar Group), deducting the assets sold and other dues (USD258.73

million – RMB1.67 million)

This asset exchange enhanced

Adisseo’s profitability. Bluestar New Chemical’s new chemical material business

recorded severe financial loss: nearly -USD123.87 million (RMB800 million),

with 0% gross profit margin in H1 2015 (all its businesses after 30 June 2015

were exchanged out). The acquisition of the shares in Bluestar Adisseo eased

these losses. Finally, Adisseo realized a turnaround in financial performance

in 2015, thanks to its health and nutrition business.

After this restructuring,

Adisseo’s main businesses transformed from new chemical materials to the

R&D, production and sales of feed additives for animal nutrition, main

products covering functional products, specialty products, and other animal

feed additives.

Adisseo's financial performance by product, 2015

|

Product

|

Revenue, million USD

|

YoY change, %

|

Operating costs, million USD

|

YoY change, %

|

Gross profit margin, %

|

YoY change, percentage point

|

|

Functional products

|

1,596.50

|

28

|

771.21

|

-4

|

52

|

+17

|

|

Specialty products

|

213.81

|

10

|

95.37

|

-8

|

55

|

+9

|

|

Others

|

79.07

|

-12

|

53.39

|

-13

|

32

|

+1

|

|

Subtotal

|

1,889.38

|

23

|

919.97

|

-5

|

51

|

+14

|

|

New chemical materials

|

432.48

|

-66

|

430.63

|

-65

|

0

|

-1

|

Note: Functional products:

mainly methionine, vitamins, ammonium sulfate and sodium sulfate;

Specialty products: mainly

enzymes preparation, rumenprotected methionine and organic selenium additives;

Others: mainly carbon

disulfide, sulfuric acid and services of processing powder.

Source: Bluestar Adisseo

Company

In 2015, Adisseo’s health and nutrition business

recorded YoY rises.

-

Revenue: USD1.89 billion (RMB12.20 billion), up by 23% YoY

-

Net profit: USD433.90 million (RMB2.80 billion)

-

Gross profit margin: 51%, up by 14.5 percentage points YoY

“These rises were mainly

because the shortage in methionine boosted its market price to an

extraordinarily high level, while the fall in oil price reduced the production

costs,” analyzed Adisseo.

Functional products, including

vitamin A and methionine (65%+ of the total), are the leading part in the

overall health and nutrition business:

-

Revenue: USD1.60 billion (RMB10.31 billion), up by 28% YoY

Methionine was the vital

contributor for this rise. In H1 2015, the short supply of methionine boosted

the market price, and further, the sales of Adisseo’s functional products.

According to CCM’s price monitoring, China’s market price of methionine reached

USD11,394/t in April, hitting a record high.

Meanwhile, thanks to the

falling price of oil (raw material for methionine) and strict control, Adisseo’s

operating costs fell by 4% to US.

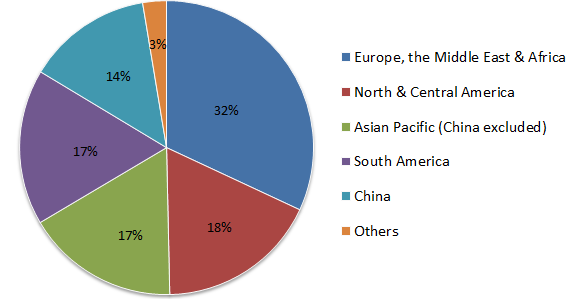

Adisseo's sales distribution of health and nutrition

business, 2015

Source: Bluestar Adisseo

Company

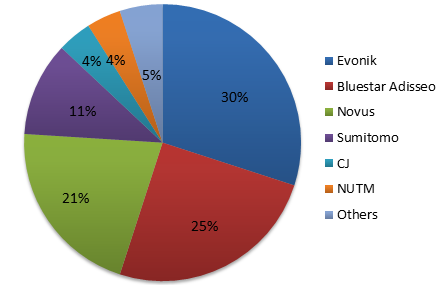

Global production capacity distribution of methionine,

2015

Note: Evonik short for Evonik

Industries AG;

Bluestar Adisseo short for

Bluestar Adisseo Nutrition Group Ltd.;

Novus short for Novus

International, Inc.;

Sumitomo short for Sumitomo

Chemical Co., Ltd.;

CJ short for CJ Group Co.,

Ltd.;

NUTM short for Ningxia

Unisplendour Gas Chemical Co., Ltd.

Source: Bluestar Adisseo Company

Notably, in Q1 2016, Adisseo continued its upward

financial performance, despite the falling market price of methionine.

According to CCM’s price monitoring, China’s average market price of powder

methionine decreased by 38% YoY to USD4,547/t in Q1. However, the company’s net

profit was reported a YoY increase of 16% to USD86.81 million (RMB561 million).

This increase was mainly

thanks to its larger sales.

According to the annual

report, Adisseo has been the second largest methionine producer in the world,

with its global market share rose from 23% in 2012 to 27% in 2015. In 2016, the

company’s 140,000 t/a liquid methionine project has been capable of producing

at full capacity, which will be favorable for its further market expansion.

At present, Adisseo’s total

production capacity of methionine achieved 360,000 t/a. In particular, its

140,000 t/a liquid methionine project was constructed in Nanjing, China.

Altogether, the company has 6 production bases, located in France (Commentry,

Les Roches, Roussillon, and La Rochelle), Spain (Burgos) and China (Nanjing)

respectively.

* This article comes from Amino Acids China News 1604, CCM.

About CCM:

CCM is the leading market intelligence provider for

China’s agriculture, chemicals, food & ingredients and life science

markets. Founded in 2001, CCM offers a range of data and content solutions,

from price and trade data to industry newsletters and customized market

research reports. Our clients include Monsanto, DuPont, Shell, Bayer, and

Syngenta. CCM is a brand of Kcomber Inc.

For more information about CCM, please visit www.cnchemicals.com or get

in touch with us directly by emailing econtact@cnchemicals.com or

calling +86-20-37616606.

Tag: methionine, Adisseo